VAT & Corporate Tax Registration

Yumna Smart Documents Clearing LLC Businesses must register for VAT if their annual turnover exceeds a specific threshold (this threshold differs by country).

Voluntary Registration: In some cases, businesses can register for VAT voluntarily even if their turnover does not exceed the threshold.

Corporate Tax Registration Services

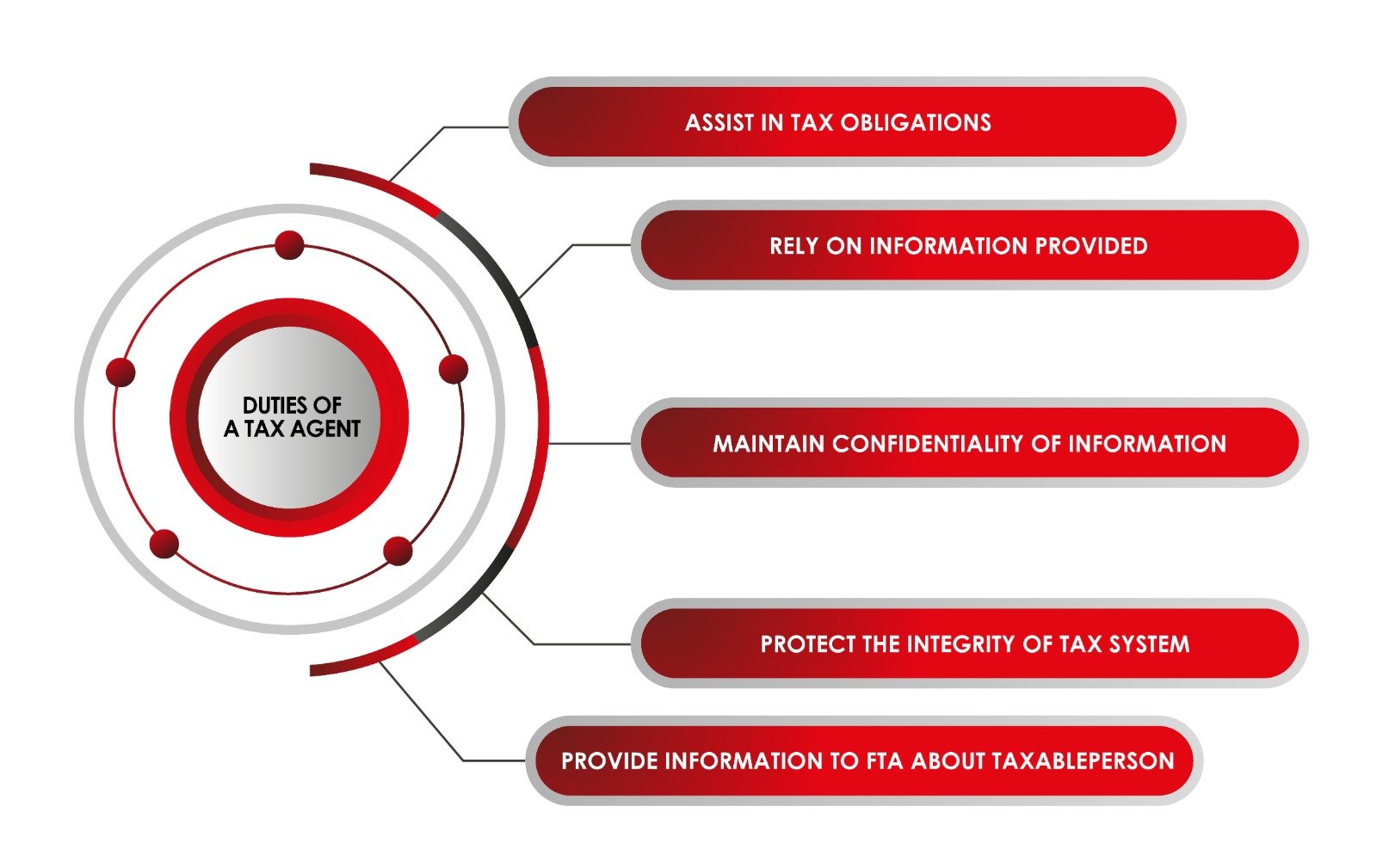

Eligibility Check: Identifying whether your business is subject to corporate tax.

Registration Application: Assisting in completing and submitting the application for corporate tax registration with the FTA.

Document Preparation: Collecting required documents such as financial statements, business contracts, and ownership details.

Corporate Tax Advisory: Providing guidance on tax planning, structuring, and the implications of corporate tax on your business operations.

Tax Filing & Compliance: Offering ongoing assistance with corporate tax filings and compliance, ensuring deadlines are met and tax obligations are properly fulfilled.

Tax Refunds: Assisting with any corporate tax refunds, if applicable.

Get in Touch

- PRO Services

- Tasheel, Amer Services

- Emirates ID & Medical Typing

- Labour Immigration Services

- Dubai Economic Deparment

- Ejari Services

- Company Formation Services

- Dubai Police Service

- Documents Attestation

- All Types Visa Services

- TAW-JEEH Services

- R.T.A Services

- Driving Licence Renewal

- VAT & Corporate Tax Registration

- Fine & Removal Services

- Pakistani Passport Renewal

- Pakistani CNIC Renewal

- Online Ticketing Information

- Professional CV Making

- Photo Copy Emails